Download the free guide

Aenean eu leo quam. Pellentesque ornare sem lacinia quam venenatis.

July 12 2023

Understanding Invoicing and Payments for Off-Duty/Extra-Duty Jobs

One of the most important things about off-duty details - perhaps THE most important thing - is officer payment.

Officers don’t work extra jobs just for fun, and they need to get paid for their work in a timely manner. In many cases, however, payment to the officer is hindered by a lengthy invoicing and payment process. Clarity in the payment process is essential to ensure adherence to agency policy and to set appropriate expectations for both vendors and officers.

How LEAs Typically Handle Off-Duty Pay

The Common LEA Payment Process

The invoicing and payment process for many off-duty/extra duty jobs is fragmented and can be inconsistent from agency to agency. Payment methods also vary - from cash in hand to mailed checks.

When a vendor chooses to mail a check, the agency coordinator invoices the vendor on the officer and agency’s behalf, and the coordinator is responsible for ensuring delivery of the payment to the officer for each job. Manually keeping track of all the invoices and payments for off-duty work at a law enforcement agency can quickly become a time-consuming task.

Current Payment Process (aka "the manual way")

Typically, when the vendor works with the agency’s coordinator, paying by credit card or ACH is not an option and the typical payment types are cash or check. Without using an off-duty management tool or service, agencies are stuck with manual processes to manage invoicing and payments. This can be cumbersome to the vendor too, since many use online or electronic payment processes to manage their business.

A Technology Solution Can Help Facilitate Payments and Benefit Both Officers and Vendors

A Technology Solution Can Help Facilitate Payments and Benefit Both Officers and Vendors

There are service providers that help agencies speed up the process by taking on the role of the coordinator and assuming the payment process responsibilities. However, RollKall is the only solution provider with an online platform made specifically for all agencies, vendors and coordinators to manage the entire payment process (as well as the rest of the details of off-duty jobs) all in one place.

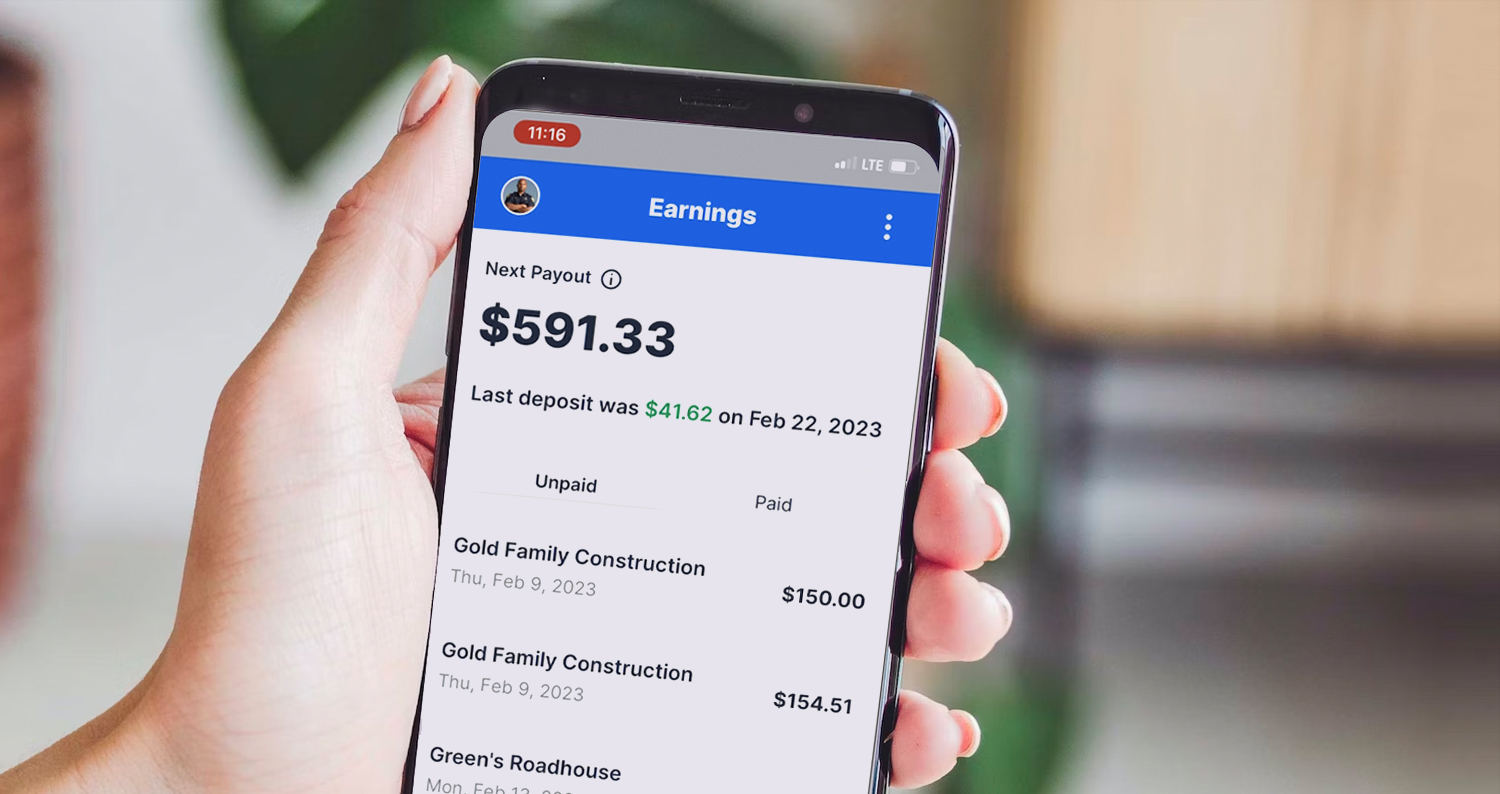

RollKall’s specialized features, such as combined job invoicing, combined officer invoicing, the ability to pay online and the option to auto-generate invoices upon clock out, simplify the invoicing process for the agency, officer and the vendor. RollKall also makes it easy for officers to get paid via direct deposit and track payments.

How RollKall Helps Facilitate Off-Duty Management

RollKall offers several options to manage the off-duty process, so agencies can work exactly the way they want or require:

RollKall can be a managed service provider and do it all for you. From scheduling, invoicing, and officer payment, we can manage the process to improve efficiency and accuracy for your agency.

An agency can keep management of the off-duty process in-house. Our online platform for agencies and coordinators and mobile app for officers allows your agency to maintain all security and policies in a unified software solution.

We can work with the agency to create a hybrid of the two. RollKall is capable of supporting your agency in a shared solution of services.

RollKall is proudly backed by investors that are eager to support law enforcement and help provide a newer, technology-focused solution that allows agencies and officers to streamline every part of the process. Additionally, RollKall is the only provider that doesn’t rely on pre-payment from the agency’s vendor unless prepayment is mandated by the agency.

How Officer Payments Work with RollKall

RollKall has three electronic payment options for officer payments:

1) Standard invoicing that takes about three days to be direct deposited after the vendor’s payment on the invoice clears 2) vendor prepayment that allows officers to be paid the day after the invoice is paid and processed through their bank, or 3) same day, expedited payment by RollKall which has an associated convenience fee.

How an agency is set up to use RollKall can also affect how and when an officer gets paid. Payments for secondary jobs are usually processed in 1 of 3 ways:

• Officers are paid through their agency's payroll (reported on their W2)

• Officers are paid directly by the vendor (reported on a 1099)

• Officers are paid in a combination of the above, depending on the agency rules

How does an officer get paid for jobs through RollKall and how long does it take?

Officers don’t want to be left wondering when they will get paid, which is why we do everything we can to make sure officers are paid in a timely manner. Using the RollKall platform and mobile app, the invoicing process works like this:

- The officers clock out of the job and submit their invoice through the RollKall mobile app. This is the first step and begins the invoicing and payment process for the vendor and officer.

- The coordinator approves the invoice on the RollKall platform and it is automatically sent to the vendor for payment.

- The vendor approves and pays the invoice online through RollKall.

- Once the payment is processed through the vendor’s bank, RollKall immediately transfers the money to the officer’s account. (The officer will then receive the payment in their account depending on the bank’s payment processing time which can take 3-5 business days. RollKall processes all payments immediately and never holds officer payment.)

Using a technology solution from a trusted provider helps ease and automate the invoicing and payment process and give insight into timelines while ensuring policy compliance. With RollKall, an agency can reduce administrative work and facilitate electronic payments, all while ensuring officers are paid efficiently and promptly.